Tax Forms and Sexism

A short story about sexism in the German tax system.

This piece is a translation of a text that I had written as part of a weekly column on the German portion of this website. Since it has made a huge splash in the German media over the week and I have received many questions about it from friends who don’t speak German, I have decided to translate it here. I’ve also added a footnote that didn’t appear in my original column to explain some very German things that people from other countries might not be aware of.

In our household, my wife is filing the tax returns. Why? Because she’s better at dealing with money things than I am. I am the creative part of the relationship, she deals with all the complicated stuff. Since we’re somewhat progressive, we use a computer to file our taxes with the government. Last year, my wife handed in the first tax return for the first tax period in which we both lived in Hamburg. Since then, we’re waiting for the tax office to approve it.

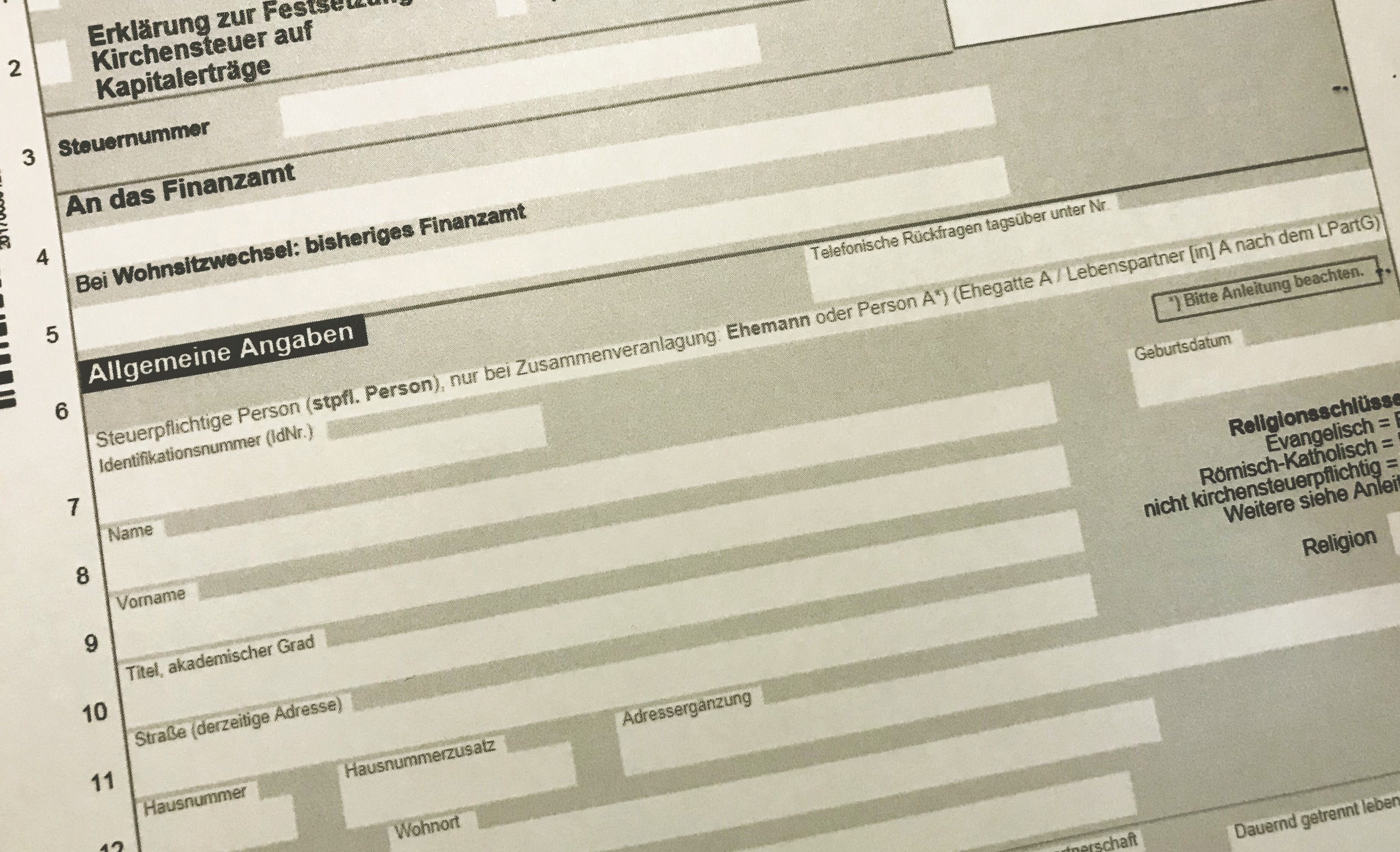

Because the whole thing has taken its sweet time, my wife called our tax office and asked what has caused the holdup. The employees there were really nice and helpful. But they also explained to her that it’s a problem if she puts her own data in as the main taxpayer in the household (what the form calls “person A”)1. They asked her nicely not to do that, because the software at the tax office isn’t made to deal with this. If the husband hasn’t filed as the first person on the form, the software crashes and the tax people have to re-enter all the data by hand. That takes time.

When I hear stuff like that, I seriously ask myself if the software backend at the tax office was programmed in the ’60s. This is the 21st century… You’d think a woman would be able to file taxes for the household and put herself in the form field for the person who’s filing. Why does it matter which partner is listed where on the forms? How does it work when two married women file their tax returns? I mean, whoever’s listed as person A in that case certainly isn’t the “husband” – it’s wrong either way then.

Bad enough that the letters from the tax office have been addressed to me for years, even though my wife has been doing all the work. But this is just getting ridicolous. I’m usually not somebody who subscribes to the argument that changes in wording lead to equality. But in this case, I think the tax office should at least use software that keeps up with the lifestyle of the country’s citizens well enough to not crash when somebody files their tax returns.

-

You see, in Germany, when you are married, you can file your taxes together and potentially save quite a lot of money doing so. That has never been the case with me and my wife as we both earn pretty equally (she’s always earned more, though) and the tax deduction system is not designed for that.

Since the beginning of the tax system in Germany (probably under Bismarck), it has been assumed that the person filing the taxes is the husband and will fill out the form as “person A”, whereas the wife will be “person B”. It actually says “husband” or “person paying the taxes” on that field. I think they only added “person A” and “person B” when same-sex couples were allowed to file their taxes together and also get rebates a few years ago. ↩︎